Breaking News

Popular News

What if you had a Paraguayan twin brother?

Imagine the following experiment: you have an identical twin. Same income, same lifestyle, same quirks, even the same questionable taste in relationships. But there's one detail that changes everything: he was born in Paraguay - a country with an income tax of 10% - and you were born in Brazil.

Done. A single variable. Now let the numbers do their job.

What happens to your assets over 40 years?

When could everyone retire?

And how much do they both accumulate at the end of their lives?

Let's take a look at the scenario.

They both start working at the age of 20.

Both win R$ 15 thousand a month, adjusted for inflation, and achieve a real return of 5% per year in investments.

The discipline is identical: each one keeps 30% of the money left over after taxes. The only difference is the passport.

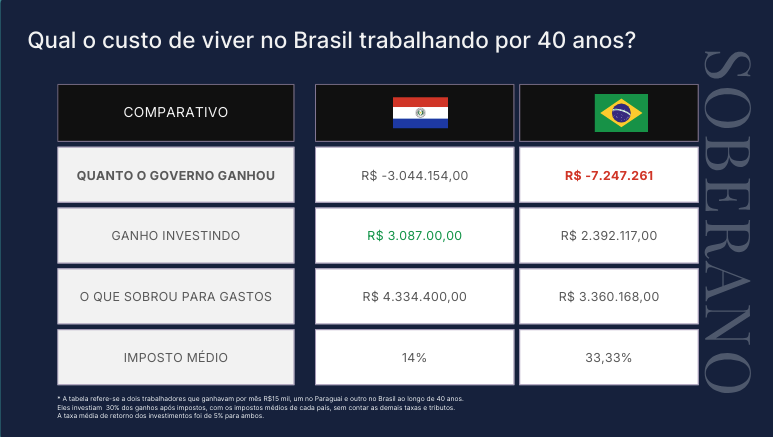

With income tax of 10% and an average load of 14% per year:

Accumulated equity:

It's the kind of asset that guarantees a peaceful retirement - and still has enough left over to leave a legacy.

Now we come to the national territory, where the average tax is 33.33% per year, with IR of 27.5%.

And here's a warning: we're being generous. In the real world, the bites are bigger.

The result?

The difference with his Paraguayan brother at the age of 50 is R$ 694.883 - the price of a middle-class house in much of Brazil.

Over 40 years, you would have left more than R$ 7 million in taxes for the Brazilian state. Some of this money could have improved his quality of life and allowed him to spend more than R$ 1 million, such as going out with friends, playing video games or traveling.

See the comparative table on the cost of living in Brazil vs. Paraguay:

The question is not whether living in Brazil is better than in Paraguay. It's about how much of your life Brazil consumes to give you a homicide rate higher than Paraguay's, a precarious infrastructure and immense levels of corruption.

And yet, if you prefer to live in Brazil, we have a way out for you. Our lawyers, tax experts and accountants can guarantee you Paraguayan tax residency, allowing you to spend most of your time in Brazil.

Be Sovereign, stop wasting your time and money on a country that doesn't give you a return. Get in touch with us:

See also: