Breaking News

Popular News

Argentina's currency crisis opened the way for the country to become an experiment in the use of digital assets. Chronic inflation, strict exchange controls and limited access to hard currency pushed millions of people out of the traditional financial system, and stablecoins filled this vacuum.

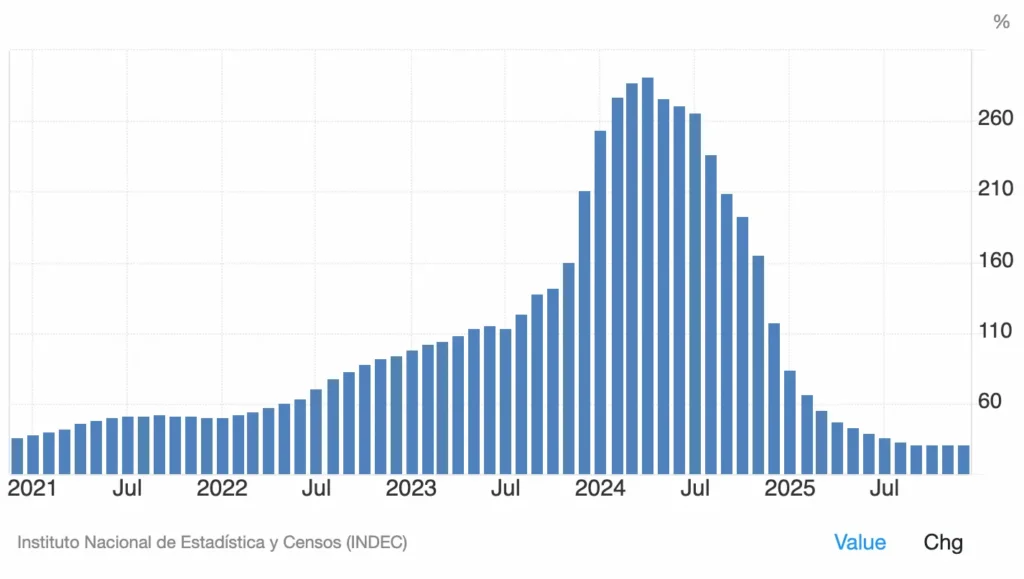

Annual inflation in the South American country passed 200% in 2023 and peaked at 292% in 2024. And although it has fallen more recently with the Milei government's economic reforms, it still stands at around 30%, considered quite high by normal standards.

Thus, the use of digital assets was not born in Argentina simply as an ideological bet or a hope of appreciation. In fact, the adoption of crypto emerged as a direct response to the failure of state money to fulfill its basic functions: preserving value and providing predictability for voluntary exchanges.

The result is an ecosystem where digital dollars circulate naturally, both to protect assets and to make everyday payments.

The central point of Argentine adoption is functional. Stablecoins are used because work, not because they deliver some speculative gain.

In an environment where the peso is continually losing value, keeping a balance in stablecoins pegged to the dollar has become a common form of defense. More than that: these assets have come to be used to pay for services, settle informal agreements, send money out of the country and maintain minimally predictable commercial operations.

This dynamic has transformed the digital dollar into something other than a simple hedge. It began to act as operating currency, It runs parallel to the official system, but with more efficiency and less friction.

Rocelo Lopes, CEO of RezolveAI's Global Stablecoin Initiative, compared the phenomenon to a common language between systems:

“[Stablecoins] function as a common language between different systems. They are stable, operate 24 hours a day and allow global settlement without relying on the traditional banking circuit. This completely changes the dynamics of payments in emerging markets”

The use of crypto in Argentina is not restricted to technical profiles or experienced investors. It is spreading because it meets concrete needs in the real economy.

Liberal professionals received for a long time in stablecoins to escape forced conversion to the official exchange rate, especially during the strictest periods of exchange control. Families still use digital dollars today as a short-term reserve, replacing much of the bank bureaucracy.

This behavior creates a functional parallel economy, where the main criterion is no longer ideological conformity but practical efficiency.

As usage matures, the debate stops revolving around “which crypto to use” and starts focusing on how value circulates. How to convert local currency into digital assets and vice versa? How to ensure predictability and less friction in payments?

This shift in focus is crucial. Stablecoins are no longer seen as isolated products, but as infrastructure layers, connecting local economies to a global digital financial system.

What is happening today in Argentina anticipates discussions that other Latin American countries are still beginning to face.

High inflation, fragile currencies, expensive and inaccessible banking systems form fertile ground for hybrid solutions, which combine local payments with global digital settlement. It's no coincidence that the region has become one of the most advanced hubs in the practical adoption of stablecoins.

In this context, Argentina acts as a real-time laboratory: shows how digital money is integrated into everyday life when the state alternative fails.

The Argentine experience shows that stablecoins and cryptocurrencies don't thrive on talk or marketing, but by solving real flaws in the monetary system. It is this practical logic that is beginning to spread to the rest of Latin America, including in Brazil with DePix, USDt e Bitcoin.

Want to learn more about how to integrate cryptocurrencies into your business in an easy and practical way, potentially lowering your costs and increasing your privacy? Contact Soberano using the form below: