Breaking News

Popular News

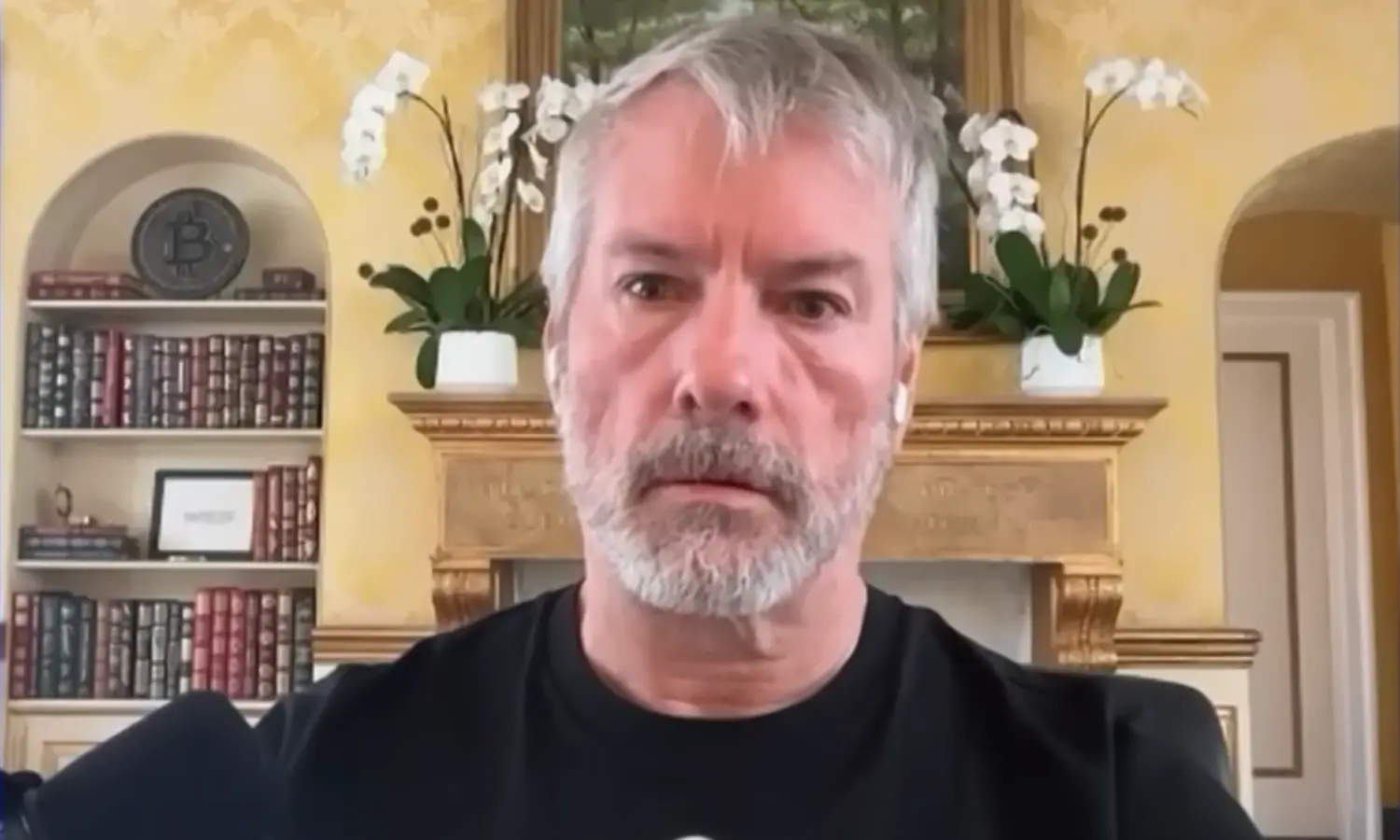

Bitcoin's price recently fell below the average purchase price of Strategy, the world's largest institutional buyer of BTC. This reignited rumors that the company could be forced into liquidation, since it takes out loans to invest in the cryptocurrency. The CEO denied the possibility.

Strategy is an American company, formerly known as MicroStrategy, which has become the world's largest Bitcoin Treasury Company. That is, a publicly traded company that uses a large part of its cash and reserves to buy and hold Bitcoin as a strategic asset. According to public data, she holds 714,644 BTC on its balance sheet, the equivalent of around US$ 49 billion.

For Michael Saylor, the entrepreneur at the head of the former MicroStrategy, the fear of liquidation is nothing more than a misunderstood myth about leverage. According to him, Strategy not only does not intend to sell, as follows committed to buy Bitcoin on a recurring basis.

“This is an unfounded concern. The truth is that our net leverage ratio is half that of a typical investment company”, said Saylor in an interview with CNBC.

In addition, the CEO said that he has enough dollars on the company's balance sheet to pay out two and a half years of dividends. This structure, according to him, gives the company a comfortable margin to go through cycles of high volatility without having to liquidate strategic assets.

The significant fall in Strategy's shares over the last year doesn't seem to worry Saylor either. He stresses that the company was designed from the outset to function as a leveraged instrument for Bitcoin exposure.

“The company is designed to be an amplified Bitcoin. When Bitcoin goes up, we go up faster. When Bitcoin goes down, our volatility is higher.”

In his view, the most common mistake investors make is analyzing Bitcoin and companies exposed to it with short time horizons. Looking at horizons of at least four years, BTC has still outperformed traditional assets two or three times.

It's worth remembering that just a few months ago Bitcoin hit an all-time high, reaching 126,000 dollars per coin at the beginning of October 2025.

Asked about an extreme scenario where the price of BTC fell and didn't return for two and a half years, Saylor again shied away from the forced liquidation narrative. The executive stated that he would have financial alternatives before considering selling Bitcoin.

“If Bitcoin falls 90% over the next four years, we will refinance the debt,” said Saylor.

Asked if he thinks banks would lend money to Strategy in this scenario, he replied that “yes, because Bitcoin's volatility is such that it will always have value”.

“Look, we're at US$ 68,000 now. It would literally have to drop to US$ 8,000 and then we would refinance the debt. If you think it's going to zero, we'll deal with it. But I don't think it will go to zero and I don't think it will drop to 8,000 either. But the credit risk is minimal at the moment.”

Obviously, Saylor has a vested interest in making the public believe that there is no credit risk. In practice, his company can withstand two and a half years of bear markets before being forced to look for alternatives to liquidate its Bitcoin positions.

Do you want to deepen your understanding of Bitcoin and financial sovereignty? If you have any questions, want to better organize your studies or understand how to use sovereign tools in a practical and safe way, fill in the form below.